IDentity Theft

1. Many cases of identity theft involve one family member stealing the identity of another family member.

2. Fixing your credit due to identity theft all begins with the same document; a police report.

3. Many cases of identity theft are preventable with a bit of care and caution such as:

a. Don’t read your credit card out in a public place;

b. Buy a shredder and make sure all documents with any personal information on them get shredded;

c. Don’t fall for scams! The IRS, FBI and your bank do NOT communicate with you by email.

d. Anyone asking for your social security number had better be someone that you know need it.

e. Don’t give your passwords, credit card information or social security number to anyone that you would expect to already have that information. If someone calls from your bank saying they need any of this information, hang up.

IDentity Theft facts & statistics: 2019-2022

Identity theft is a major problem for consumers, resulting in billions of dollars in financial losses each year. Here are several key identity theft statistics that help put a face to the continuing threat. To date, we have compiled over 30 identity theft facts, figures, and trends from a wide range of sources and covering a number of different countries.

Identity Theft Resource Center & Black Researchers Collective Research Finds ID Crime Victims in Black Communities Lose More Money Than General Population.

Press Release Date: 01/04/2023

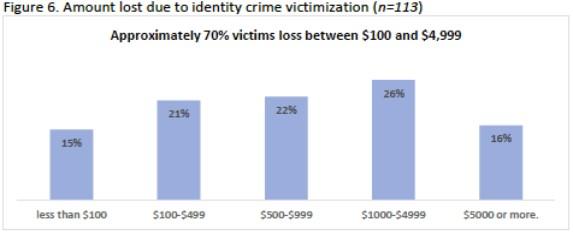

A new study finds that 16 percent of ID crime victims in Black communities lose more than $5,000 to identity criminals

Black communities experience a higher rate of victim loss in every category in the research findings than what is reported in the ITRC’s 2022 Consumer Impact Report (CIR), where Black people were also included in a largely non-Black sample. According to the responses, 16 percent of victims reported losing at least $5,000. Twenty-six (26) percent lost $1,000-$4,999, a 17 percentage point increase compared to the victims surveyed in the 2022 CIR.

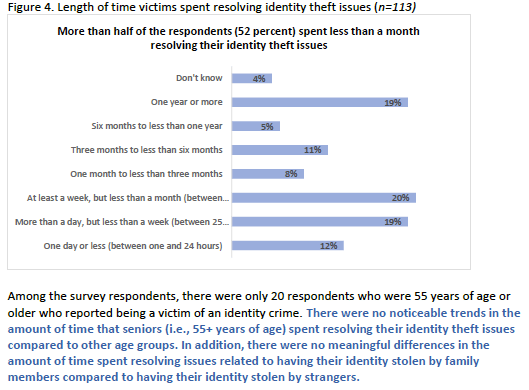

Researchers found that victims did not just lose significant amounts of money; they lost time spent resolving their identity theft issues.

Nineteen (19) percent of respondents spent a year or more resolving their issues.

Sixteen (16) percent of respondents spent three months to a year resolving their identity theft cases, an eight (8) percentage point increase compared to General Victims surveyed in the 2022 CIR.

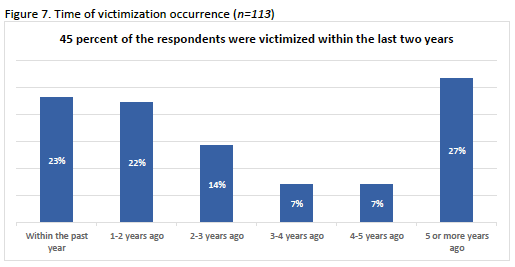

Nearly half of the participants (45 percent) reported becoming a victim within the last couple of years and either experienced fraudulent charges on their debit or credit cards or had their personal identification information compromised.

According to the data from the survey, when victims experienced identity theft, 72 percent reported it to a family member or friend. Sixty-three (63) percent notified a bank, credit card company or other payment provider. Fifty (50) percent reported it to law enforcement. Most of the survey participants (80 percent) reported having their identity stolen by someone they know.

“We believe there is a lack of data around identity theft victimization in Black communities that creates risk of becoming a victim,” said Eva Velasquez, President and CEO of the Identity Theft Resource Center. “This is the first step in understanding identity issues in the different communities. This effort allows us to develop specific programs that will help victims recover and resolve identity crime.”

Other findings include the following:

Fifty-four (54) percent of the respondents who were the victim of an identity crime obtained identity theft protection because they wanted to protect themselves from becoming a victim in the future.

Sixty (60) percent of the survey respondents indicated they have identity theft protection. •However, only 39 percent of survey respondents had identity theft protection when they became the victim of an identity crime.

There is not a significant difference in the amount of time spent resolving identity theft with identity theft protection.

1. Over 12,000 reported data breaches occurred in the US between 2005 and June 2020, which help contribute to identity fraud

Alongside the 12,098 reported data breaches in the US between 2008 and June 2020, there were over 11 billion records stolen during that time frame. The numbers reveal that contrary to efforts to stem the tide of data theft, thieves are learning new ways to bypass protections, and much of our data is not protected at all.

2. Number of fraud incidents still rising

- Number of fraud incidents still rising

2021 saw a three percent increase in the number of identity theft reports versus the year prior. In fact, these accounted for a quarter of all fraud reports; that’s 1.4 million separate incidents.

3. Fraud losses up 45% between 2019 and 2020

Identity theft incidents almost doubled between 2019 and 2020. The total amount of money lost due to identity fraud was also on the rise.

According to the FTC, reported losses grew from $1.8 in 2019 to $3.3 billion in 2020 and $5.8 billion in 2021. However, it is worth noting that these figures do not necessarily account for all losses, since many victims are hesitant to come forward.

4. Account takeovers up 20 percent in 2020

Account takeovers occur when a criminal gains access to someone’s accounts holding personal information.In 2019, account takeovers were up 72 percent over the previous year. According to Kaspersky this number of account take over incidents grew by another 20% in 2020.

5. 40% of account takeovers happened in just one day

Javelin Research found that fraudsters are fast in their efforts to take over accounts. The company’s 2020 research on identity fraud reports that 40% of takeovers happen within 24 hours of a criminal’s access to a victim’s account.

6. EMV chip credit cards helped to reduce some fraud

EMV chip adoption in the US was slow, but by Q2 of 2021, around 88% of merchants had POS systems in place to accept the chips (up from 67% in 2020), while every major card issuer had already switched to delivering cards with EMV chips.

Prior to EMV chip cards, credit card fraud was the single-largest source of identity fraud losses. However, counterfeit card fraud fell 75% after EMV card rollouts.

7. The pandemic was a leading cause of fraud

The pandemic caused a noticeable effect on the scams that transpired in 2020 and 2021. Unsolicited calls, robocalls, and phishing emails saw dramatic increases during the period in question due to lockdown.

These identity theft scams, including the theft of social security numbers, were used as an attack vector to steal the PII needed to engage in false claims and contributed to a dramatic increase in false claims (more on this later).

Finally, digital payment methods used to shop from home during lengthy lockdown periods also accounted for an increase in fraud, with 18 million victims reportedly affected.

8. Stolen credit card data is often sold on dark web marketplaces for as little as $0.50 per card

Although the cost of losing credit card information can be extensive, those selling that data on the dark web often do so at incredibly low prices. Symantec found single credit cards priced as low as $0.50, and some as high as $20 each. Cards with full details, including CCV numbers, were more commonly twice as expensive, and often run between $1 and $45 per card.

Data from skimmed magnetic is often the most expensive card data on the dark web. The asking price for those can range from $5 to $60 or more.

9. Most people in the US know an identity theft victim

Around 20% of Americans were victims of identity fraud in 2021. Those numbers indicate that if you live in the US, you have likely been a victim of ID theft or known someone who has (whether they’ve admitted to it or not).

10. UK identity theft reaching “epidemic levels”

In 2017, Cifas announced that identity fraud in the UK is reaching “epidemic levels” with fraud incidents occurring at a rate of 500 per day. Unfortunately, things only got worse in 2020, with a one-third increase. There was a further 11 percent increase in the first half of 2021, just as the pandemic took hold. Notably, 42% of reported incidents were committed with the goal of obtaining a credit card.

11. Account takeovers saw a huge increase between 2019 and 2020

Account takeovers have been on the rise for a while but spiked 70% in 2019, bringing losses associated with account takeovers to a staggering $6.8 billion USD, up from $5.1 billion the previous year. In 2020, account take-overs continued to rise, with Javelin finding that account take-overs let to ID theft that accounted for losses of $56 billion USD.

Account takeovers have been on the rise for a while but spiked 70% in 2019, bringing losses associated with account takeovers to a staggering $6.8 billion USD, up from $5.1 billion the previous year. In 2020, account take-overs continued to rise, with Javelin finding that account take-overs let to ID theft that accounted for losses of $56 billion USD.

According to the Identity Theft Resource Center’s 2021 report, cyberattacks, phishing attempts, and ransomware are all increasingly common. This accounts for everything from formjacking to inadvertently installing a Trojan, although research indicates that criminals are much more likely to target a vulnerability in public-facing systems than before. To illustrate this, there were around two million attempts to exploit Microsoft Server bugs in Q2 and Q3 of 2021 alone.

12. Account takeovers spiked 307% during the pandemic

Sift has revealed that account takeovers have more than tripled since April 2019, with almost half of all victims suffering this fate between two and five times. Over 80 percent of victims lost money this way, and more than a quarter lost loyalty points or reward points to scammers.

13. People in their 30s most likely to be victims

According to the FTC, there were 2.8 million fraud reports from consumers in 2021, a nearly 27% increase over the 2.2 million fraud reports in 2020. 26.4% of these were from people between the ages of 30 and 39, while just 4.7% were from people over 70 years old. However, it recently launched an online platform for reporting fraud, which may see these numbers increase more than usual, given the ease of which users can file a report.

14. Identity scams were the most commonly reported scam in the US in 2021, followed by imposter scams

The 2021 FTC Consumer Sentinel Data Book reveals that identity fraud accounted for the largest share of fraud reports to the FTC, accounting for 25% of all reported scams last year. Imposter scams were a distant second, with 17.16% of all scam reports.

15. Social media users are a high-risk group for identity theft

Those who use social media are among the most likely to experience fraud. Javelin Strategy found that individuals who have an active social media presence had a 30 percent higher risk of being a fraud victim than those who weren’t active.

People who use Facebook, Instagram, and Snapchat were particularly vulnerable. Users on these sites have a 46 percent higher risk of account takeovers and fraud than those not active on any social media networks.

16. Children are often victims of identity fraud

According to the Identity Theft Resource Center, 1.3 million children’s records are stolen every year. Foster children have an even greater risk as a percentage of all children.

Self-reported data to the FTC indicates that over 22,833 identity theft victims were under the age of 19 in 2021. This reflects a 63% increase over the 14,000 reported in 2019.

17. Over 1 in 10 identity theft victims don’t want police reports

FTC data from 2016 shows a surprising 11% of those who reported identity theft to law enforcement did not want a police report taken. While we have not seen updated stats on this in recent years, it seems likely that those who fall victim to identity theft and scams often feel embarrassed and may still be seeking to conceal the fact that they have been victimized in 2021.

18. Only 14% of consumers use VPNs to protect their identity

Despite the verified increase in data protection it provides, 86 percent of consumers fail to use a VPN to protect their Wi-Fi connections

19. Government benefits fraud leading type of identity theft

The 2021 Consumer Sentinel Network Data Book reveals there were 395,948 report of government benefits fraud that year, which is roughly in line with the 394,324 reports received in 2020.

That makes government benefits fraud the top reported type of ID fraud in 2021. Credit card fraud accounted for over 389,737 reports, putting it a close second.

Identity theft is increasingly a 21st-Century problem. As more data moves off of physical paper and onto Internet-connected servers, the chances of that data getting stolen increases as well. While “malicious outsiders” remain active in stealing data (and by extension, loss of credit card numbers and Social Security Numbers), consumers share a good part of the blame for their lost data. Nevertheless, there are some positives that have emerged in response.

Thankfully, Consumers are getting slightly better at detecting fraud attempts. Javelin Strategy and Research found that online shoppers tended to be quick at identifying fraud attempts. Surprisingly, 78 percent of fraud victims were able to detect fraud within a week’s time.

Still, identity theft prevention appears to be on the rise despite savvier consumers. Data breeches show no signs of decreasing. And unfortunately, consumers still appear to be less than proactive when it comes to securing their private information.

FAQs about IDentity Theft

How do I know if I was a victim of identity theft?

Several red flags help determine if you’re a victim of identity theft. Some of the telltale signs are listed below:

* A bank or a retailer denies you credit.

* You receive bank or credit card statements with unknown charges.

* You receive calls from debt collectors

* You no longer receive bills or statements by mail (indicating someone has changed your billing address).

What should I do if my IDentity has been compromised?

If you believe you are a victim of identity theft, you should start by contacting the fraud departments of the companies where your accounts have been compromised to ensure your money is safe and your cards aren’t being used without your permission. You should freeze any cards you believe are being used concurrently and inform your local police station. If you have ID theft insurance, you can file a claim to recoup some of the costs caused by damages.

How can I prevent IDentity Theft?

Although cybercriminals are getting more sophisticated, requiring less information for successful identity fraud, you can make their job more challenging by following these best practices:

* Use a credit monitoring service to get notified of your data being involved in a breach/significant changes to your credit file.

*Shred paper documents containing personal information.

*Keep an eye on your credit card and bank statements for unrecognized charges.Use strong and varied passwords for your accounts.

*Use anti-malware software to protect your device from threats that could steal your data.

Contact Us

444 N Michigan Ste 1200

Chicago, IL 60611

Monday – Friday 9:00 am – 5:00 pm

AS HEARD ON

AS SEEN IN

TESTIMONIES

UNBELIEVABLE, I made a mistake years ago with an ex, long story short, I was finally able to get the car he put in my name off my credit. LegalCreditSweep.org help when the police could'nt.

Copyright © 2023 Legal Credit Sweep is the Nation's Leading Mission Driven Nonprofit Consumer Credit Advocate with IRC 501(c)(3) Designation.